US gas industry

Summary

USA has largest gas marker in the world.

USA has 8 LNG plants and 113 MTPA of LNG capacity (as of 07.07.2025).

The United States is currently the leading exporter of LNG to the global market. The LNG industry in the United States began with the development of regasification terminals for LNG imports to the United States. However, thanks to the shale revolution and active pressing of Russia, the United States has rapidly become the number one LNG exporter and will only strengthen its leadership in the coming years.

The top three countries importing LNG from the United States as of June 2025 are France (8.7 million tons over the past 12 months), the Netherlands (8.4) and the United Kingdom (6.6). Europe as a whole has imported 48.4 million tons over the past 12 months.

Taking into account the pace of commissioning of LNG projects on Mexican gulf coast and the political pressure of USA on its competitors in this market, worldwide pricing in the LNG market is switching to the formula: <wholesale price of gas in the United States> + <fee for transportation and supply of gas to the LNG plant> + <fee for gas liquefaction> + <freight to the consumer>.

Natural gas production

The US natural gas market is the largest in the world. Shale gas, natural gas extracted from shale deposits, played a significant role in its development in the 21st century and the creation of the LNG export industry.

The largest groups of shale gas deposits:

Marcellus. The average daily production volume in February 2024 is 835 million cubic meters per day. Production continues to grow year by year.

Haynesville. The average daily production volume in February 2024 is 405 million cubic meters per day. Production continues to grow year by year.

Utica. The average daily production volume in February 2024 is 195 million cubic meters per day. Production continues to grow year by year.

As of November 2025, 92% of gas in the United States is produced by horizontal wells.

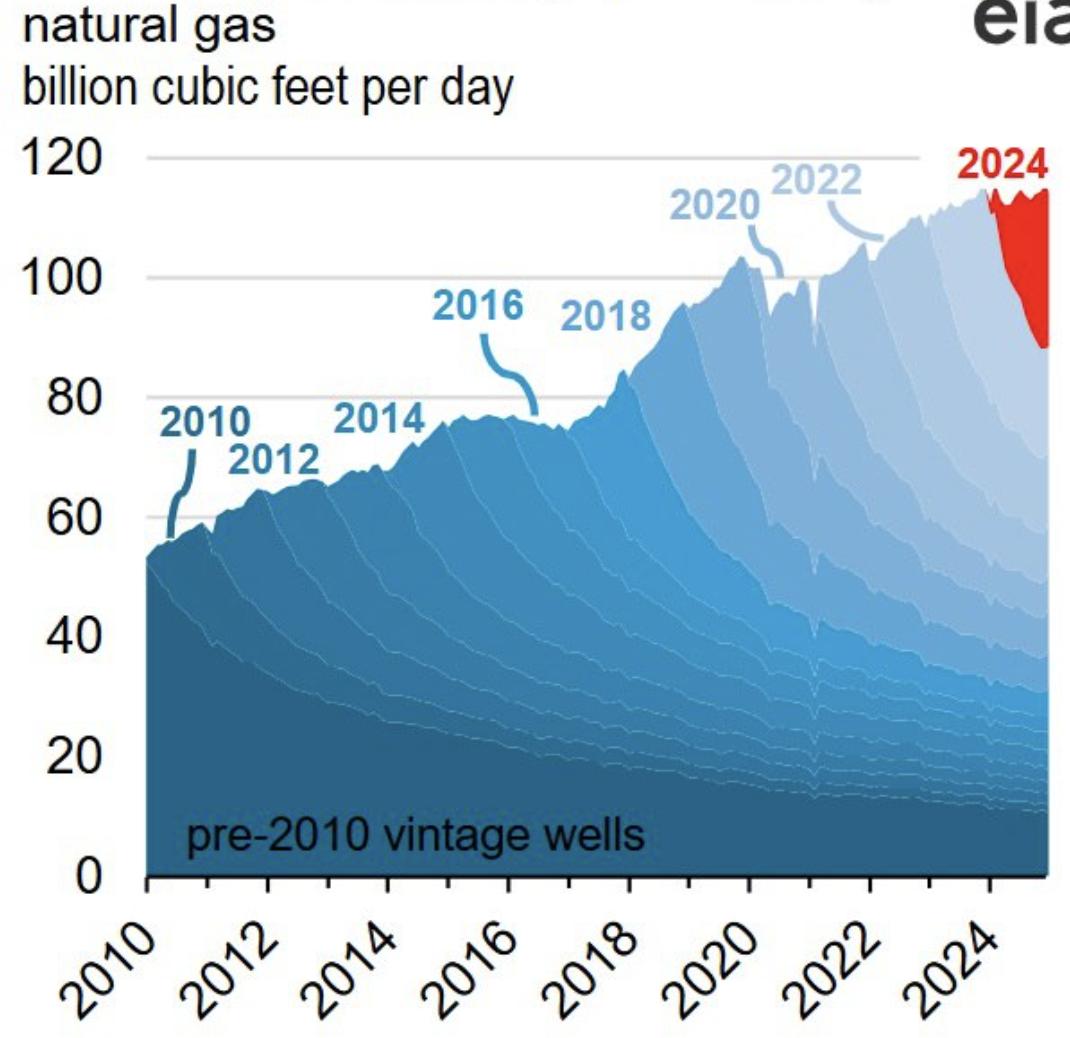

A horizontal well is a method of production intensification. Its are being drilled because the undeveloped deposits in the USA have run out. Such a well makes it possible to extract expensive gas from the point of view of the cost of production where it was previously impossible. Horizontal drilling technology requires a significant increase in capital investment compared to vertical wells. Horizontal wells, unlike vertical wells, quickly reach peak production, and then very quickly lose their debit. The rate of decline in production is noticeably faster than the rate of losses in traditional vertical wells. And this process is accelerating. That is, every year the peak return of a horizontal well is getting higher, and the subsequent collapse of returns is noticeably faster.

Average well debit rate at gas fields in the USA by type and age of well, million cubic feet per day

Rapid decline in debit rate of horizontal wells in shale gas fields requires gigantic annual drilling programs even to maintain current volumes of total gas production. Thus, as of 01.01.2025, production from gas wells drilled during 2024 amounted to 23% of the total volume of gas produced on that date.

U.S. gas production excluding Alaska and Hawaii by well launch year, billion cubic feet per day

The market price of natural gas at US market is one of the lowest in the world. Of the major gas markets, only the markets of Russia and the Middle East (the largest gas producing countries with a monopoly on the domestic gas market) have lower gas prices. The gas markets of Europe and East Asia have significantly higher prices for natural gas.

At this point in time, LNG exports are not yet marginal demand in the US domestic market (that is, they are not price-forming), however, as LNG export capacities grow, they are approaching this.

LNG plants

The first Kenai LNG plant was built in Alaska in 1969. The plant's capacity was 1.5 million tons per year. The plant operated until 2015 and at that time was the only LNG plant in the USA.

The recent history of the U.S. LNG industry begins with the launch of the Sabine Passage LNG plant in Louisiana in 2016.

As of June 2025 USA has 8 operating LNG plants:

Sabine Pass

Freeport

Corpus Christi

Cameron

Calcasieu Pass

Cove Point

Elba Island

Plaquemines

LNG pause

In 2024, the Biden administration imposed a ban on the construction of future LNG plants (so called “LNG pause“). The reason under the ban is protect giant US domestic market from changing marginal pricing from a balance of domestic supply and demand (and expected low domestic gas prices) to an export alternative (and expected high domestic gas prices). This transition would lead to a sharp (at least twofold) expected increase in domestic gas prices, then on the domestic electricity market, and a corresponding increase in energy costs for all numerous local producers. It should be noted that many countries with strong central authorities adhere to this practice of limiting domestic energy prices to the detriment of exports.

In January 2025, the new Trump administration lifted this ban.

On April 2, 2025, Trump imposed high import duties on almost all US trading partners. After that, Trump changed his approach to levying duties many times, but it was this event that became a key factor in uncertainty about future trade flows in the international LNG market. The Trump administration is forcing foreign countries to purchase LNG from the United States, as well as invest in future LNG projects in the United States, primarily the Alaska LNG plant.

In May 2025, the US Department of Energy published a study of the US gas market with the main conclusion that gas production will be sufficient for both domestic consumers and LNG exporters on the horizon until 2050.

Calcasieu Pass

In April 2025, the Calcasieu Pass LNG plant in Louisiana began formal commercial operation three years after the actual one. The owner of the plant, Venture Global LNG, founded by financier Michail Sabel, delayed the formal commissioning of its plant for three years in order to sell LNG at high spot prices in 2022-2024, rather than comply with previously concluded long-term contracts with formula prices. In terms of formula prices, LNG was significantly cheaper for customers during this period. In early April, against the backdrop of Trump's trade war, prices in the energy markets fell, which probably prompted Michail to begin fulfilling contractual obligations.

The list of buyers of so-called “freedom” molecules from this plant includes British Shell and BP, Polish PKN Orlen, Spanish Repsol, Italian Edison, Portuguese Galp, Chinese Sinopec and CNOOC. The total volume of binding supply contracts is 10 MTPA (84% of the design capacity of the LNG plant).

The buyers are conducting legal proceedings against the company that owns the plant. At the same time, deliveries to China under these agreements will obviously not be carried out in view of China's retaliatory duties.

Corpus Christi

In June 2025, the final investment decision was made on new trains 8 and 9 and debottlenecking of Stage 3. Overall capacity of the new facilities will be 5.3 MPTA. Commissioning is expected in 2028.

Plaquemines

The first train of giant Plaquemines plant on the Mississippi River was launched in Q4 2024. The plant will have 36 lines with a capacity of 560-740 thousand tons per year each. The commissioning of the lines will last until end of 2026. As of 30.06.2025, operating capacity of the LNG plant is 17 MTPA (trains 1-24).

Port Arthur

This future LNG plant in Texas has two 13.5 MTPA trains. US DOE granted on 29.05.2025 export license for train 2.

The project is developed by Sempra.

Rio Grande

The Rio Grande plant is under construction. As of September 2025, final investment decisions have been made and preparations for the construction of 4 lines have begun.

Capacity of the first three trains are 5.9 MPTA each. Commissioning is scheduled for January 2028 - January 2029.

The final investment decision on the fourth line was made in September 2025. The final investment decision on the fifth line is expected in the fourth quarter of 2025. Сapacity of each train in 5.4 MTPA.

Commonwealth

In April 2025, the US-based Kimmeridge gas company sold 24.1% of its subsidiary South Texas Holding Company, which produces gas in Texas and is developing an LNG plant construction project in Louisiana, to the Abu Dhabi-based Mubadala Fund (UAE), specializing in investments in the energy sector. Commonwealth LNG plant project includes the construction of six trains with a total capacity of 9.5 MTPA with their launch in 2029. For the Mubadala Foundation, this is the first project in the United States.

The final investment decision on the plant is expected in the fourth quarter of 2025.

Louisiana LNG

On 09.01.2026 Australian Woodside and BOTAŞ have signed a long-term agreement to supply LNG to Turkish market. Under the contract, Woodside Energy will supply BOTAŞ approximately 500 kt annually for up to nine years, beginning in 2030. LNG will come primarily from Louisiana LNG project in USA, as well as from other Woodside assets.

Alaska

Trump administration began actively developing the Alaska LNG project in Q1 2025. Total capacity of the three trains is 20 MTPA. Expected commissioning period is 2029-2031. Project cost is estimated at 44 bUSD / 3.7 tRUB / 3.8 bINR / 161 bAED / 315 bCNY. Key showstopper is to find guaranteed buyers for LNG before FID. And Trump administration is actively looking for them with cowboy lasso. First of all, through threats of so-called “reciprocal“ tariffs on the export of goods from foreign countries to the United States. Japan and the Chinese province of Taiwan are among the pre-agreed buyers to contract gas from this project.

LNG loadings and export

USA is currently the largest producer of LNG and is guaranteed to remain so over the coming years. US LNG industry is living its best life.

United States continues to successfully monetize the crisis in Eastern Europe in 2013 initiated by Biden (Vice President 2009-2017, president in 2021-2025) and elimination of Russian energy resources from European market. Commissioning of LNG plants in USA is synchronized with disconnections of Europe from Russian pipeline gas and LNG.

In the coming years, the balancing of Atlantic Basin gas market will be carried out by the United States through the supply of its LNG and, if necessary, the remaining supplies of Russian pipeline gas to Europe and Türkiye. Among the “shutdown” mechanisms already used Russia's dependence on the global gas market:

Short-term permits for Türkiye to pay for gas purchased in Russia, supplied via the Turkish and Blue Streams. Blocking other transfers from Russia to Türkiye, which for some reason still go through US banks (for example, blocking JP Morgan's transfer of $ 2 billion to a Turkish bank as part of a loan for the construction of the Akkuyu nuclear power plant). Apparently, the Erdogan administration is not allowed to make such decisions on gas imports on its own and is kept on a short leash.

Attacks by British ships and Ukrainian UAVs of onshore compressor stations of these gas pipelines, including the blowing up of Sudga and the attack on the compressor station of the Turkish Stream.

Inclusion of ice class LNG carriers in hate lists of Great Britain, USA and EU.

An attempt to take control of the bankrupt owner of the Nord Streams.

In January 2025, the goal setting of the future US foreign policy regarding China's LNG industry was implemented. The leading Chinese companies in the LNG industry, along with companies from other industries, have been declared dangerous to the United States by the Department of Defense. By analogy, the US policy was previously based in relation to the Chinese telecommunications giant Huawei, as well as Russian oil and gas companies (Sovcomflot, Novatek, Gazprom). For the upcoming Trump administration, China is the main red rag. In March and April, tariffs on imports of Chinese goods to the United States totaling 54% were introduced in two rounds (as of April 8). As a countermeasure, China imposed a tariff on LNG from the United States (10% from March and 44% from April). This has stopped LNG shipments from the United States to China since March, despite existing long-term contracts.

The table “Monthly LNG loadings volumes at US ports“ provides statistics on the loading of gas carriers in US ports with aggregation for calendar months. The data is available from October 2022. 01.MM.YYYY means shipments for the entire calendar month starting on that day. Shipments for the current month are indicated by cumulative total from the first day of the month to the current date. The delay in receiving data is up to one day. The data is updated automatically.

The table “Details of LNG loadings in USA during last 30 days“ provides the data on loading of gas carriers at gas-liquefying plants in USA during last 30 days and is updated automatically.

Trump imposed on 7.03.2025 duties on ships built in China or flying the Chinese flag to enter US ports. The exact amount of the duty has not been announced at this point in time, but ship brokers estimate its possible amount at 1.3 million rubles per one-time entry of a gas carrier into a US port.

Export destinations

The table “Destination countries of US LNG Export" provides statistics on importing countries of US LNG with aggregation by calendar months. The date of gas carrier loading is used, the data on importing country is available upon discharge. The data has been provided since 01.09.2022 and is updated automatically. Data for the current month is shown as a MTD.

The export directions are very diversified. As of 06/18/2025, the largest LNG consumers in the last 365 days are from the USA:

France - 8.7 million tons in the last 12 months.

The Netherlands - 8.4. The Netherlands is the gas gateway of North-Western Europe. In the third quarter of 2023, the decrease in imports of all LNG to continental Europe was influenced by the occupancy of European UGS facilities.

Great Britain - 6.6. Great Britain is the closest major market for LNG from the USA. However, the possibility of importing in some summer months is limited by the extremely low volume of UGS in the UK - in such cases, the import of any LNG to the UK is stopped.

Spain - 6.2

Turkey - 5.4. LNG imports to Turkey are seasonal (from October to April) and are intended to cover peak demand for gas and electricity during cold weather. LNG imports from the United States are growing every year.

Japan - 5.4. Winter exports to Japan are strongly affected by traffic jams in the Panama Canal, through which U.S. LNG carriers must pass on their way to Japan. This forces the United States to export to countries other than through the Panama Canal, and Japan, in turn, to look for a replacement for LNG from the United States on the spot market.

South Korea - 5.4

EU

European Commission plans to introduce another tax on the external import of resources to the EU - Methane Regulation (Regulation (EU) 2024/1787). Official wording is based on methane emissions at its production. Transportation and regasification segmets and foreign upstream projects controlled by EU companies will be excluded from the tax.

In December 2025, the European Commission proposed to the LNG exporter from the United States the procedural facilitation of the “audit” of gas fields. The US Chamber of Commerce once again rejected both the procedural relief and the entire initiative, as the US government basically does not want to pay any tax on its LNG.

Сhina

As a result of Trump's second trade war against China, China has practically stopped importing LNG from the United States since the fall of 2024 for political and economic reasons and, accordingly, dropped out of the list of the largest importers.

Regas terminals

There are three regasification terminals in USA:

Everett terminal has a capacity of 5.4 million tons per year in Massachusetts.

Ponce and San Juan terminals have a total capacity of 3.2 million tons per year in Puerto Rico.

Shipments to Boston take place during the cold season and usually do not exceed one standard ship shipment per month.

Pipeine export-import of natural gas

In addition to LNG exports, the United States is actively developing pipeline gas exports. The importer is neighboring Mexico, where industry is actively developing. In 2023, the United States exported 66 billion cubic meters of gas to Mexico. At the same time, as of September 2024, two more gas pipelines from the United States to Mexico with a total capacity of 55 billion cubic meters of gas per year are under construction.

Mexico's potential countermeasures in response to the Trump administration's imposition of tariffs on imports of Mexican goods to the United States could realistically include retaliatory tariffs on imports of natural gas from the United States to Mexico by LNG plants owned by U.S. companies.

Notes:

Join Seala AI’s Linkedin page to be informed for all new future releases with new dashboards and insights.

Non-mainstream oil and gas news and views are available in Seala AI’s telegram channel.

Full set of reports for each country and much more information are available via Seala AI terminal.